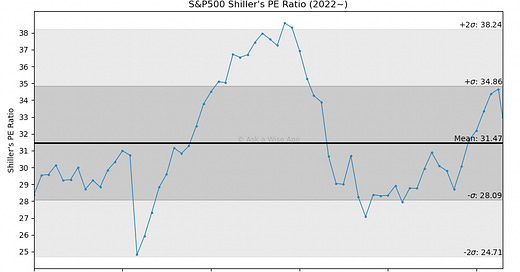

#223: Shiller's POV on US Stocks

Robert J. Shiller is an Economics professor at Yale University, recipient of the 2013 Nobel Memorial Prize in Economics, and perhaps most well known to traders as the inventor of the CAPE ratio (aka "Shiller PE Ratio")

Today we’ll take a look at:

What’s a PE ratio an…