#246: Bloody Friday in US Stocks (sort of)

In this email:

What happened to US stocks on Friday?

How did different assets perform?

How does that compare to Liberation Day?

What’s the play?

What happened to US stocks on Friday?

Friday was a bloodbath driven by Trump threatening a “massive increase of Tariffs” on Chinese imports. The catalyst? China announced new export controls on rare earths (effective December 1st) requiring licenses for any product containing more than 0.1% rare earths sourced from China.

Trump’s response was swift and hostile – not only threatening tariffs but also canceling his planned meeting with Xi Jinping at the APEC summit in South Korea. This matters because China controls roughly 70% of the global rare earths supply, which are critical for semiconductors, defense systems, EVs, and AI hardware.

How did different assets perform?

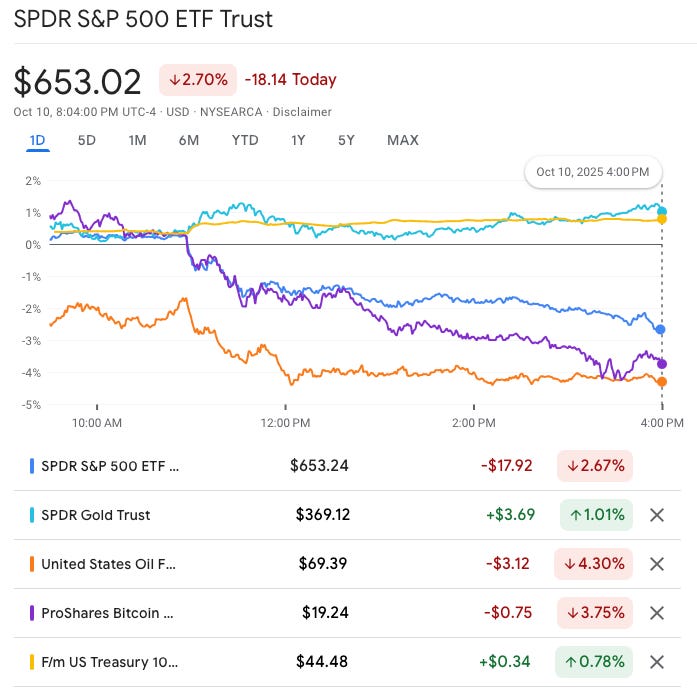

SPY (S&P 500): Down 2.67%. Broad market selloff as tariff fears repriced equity risk across all sectors.

GLD (Gold): Up 1.01%. Classic safe-haven bid when geopolitical and trade tensions spike.

USO (Oil): Down 4.30%. Tariff threats = economic slowdown fears = lower energy demand. Oil traded like a recession indicator.

BITO (Bitcoin): Down 3.75%. Risk-off sentiment hit crypto hard. So much for the “digital gold” narrative when real selling pressure hits.

UTEN (Treasury): Up 0.78%. Bonds provided stability but the modest rally suggests markets aren’t in full panic mode yet.

How does that compare to Liberation Day?

If Friday felt familiar, that’s because we’ve been here before recently on April 2 — Trump’s so-called “Liberation Day” when he announced sweeping tariffs on basically everything coming into the US.

Markets absolutely cratered, triggering the largest global market decline since the 2020 crash. Friday’s 2.7% drop was nasty, but it wasn’t Liberation Day nasty. That event was a legitimate market crash. Friday was more like a warning shot – markets saying “not this again.”

The difference? In April, we got a 90-day pause that triggered the Nasdaq’s biggest single-day gain in 24 years – a 12% rally. This time? No pause button in sight yet.

What’s the play?

Here’s the thing about tariff tantrums: they create volatility, and volatility creates opportunity.

🛡️ Long-term no-brainer:

SPY (S&P 500): Start DCA’ing in small amounts now to build your position.

GLD (Gold): Safe-haven asset that historically holds value during geopolitical chaos. A solid hedge when trade wars heat up.

⚡ Slight risk-forward:

USO (Oil): DCA’ing into crude for mid-long term recovery. Oil got punished on recession fears, but energy demand doesn’t disappear – it just gets repriced. Patient accumulation here pays off when economic anxiety fades.

BITO (Bitcoin): Same DCA strategy. Crypto sold off hard in the risk-off move, but if you believe in the long-term thesis, these pullbacks are accumulation opportunities.

UTEN (Treasury): Timing bond entries and exits around volatility spikes. When panic hits, treasuries rally. When optimism returns, they fade. Trade the fear cycle.

💡 IMO:

Start DCA’ing small amounts into SPY now – don’t try to time the bottom perfectly. Once we see a pause button equivalent (tariff delay announcement, Xi meeting back on, trade negotiation headlines, or Trump walking back the threats), that’s when you deploy the bulk of your extra cash into SPY.

I’d also throw a little into SSO (2x leveraged S&P 500) when that pause signal hits, with a tight 5% profit target. Once you hit that 5%, get out. The idea is to capture the explosive relief rally (like the 12% Nasdaq rip after Liberation Day’s pause).

For now, this is a market that rewards patience over panic.

TOGETHER WITH: URnetwork (Sponsored)

All of the privacy and all of the fun.

Join a decentralized VPN that advances the state of the art of privacy, availability, security, and performance.

✨ Say goodbye to VPN - join URnetwork here!

Ask a Wise Ape is a reader-supported newsletter. Since you’re here already, consider signing up for a paid subscription for $5/month which will give you access to the full archive (posts are archived after three months). Thank you for your contribution!

It’s a crazy world - we Apes will keep you informed.