#248: How the Fed's Next Move Could Matter for SPY: An All-Time High Perspective

In this email:

Fed x SPY Pattern Breakdown (2021~Present)

Why “good cuts” drive rallies while hiking kills momentum

What December’s FOMC decision could mean for 2026

Fed x SPY Pattern Breakdown (2021~Present)

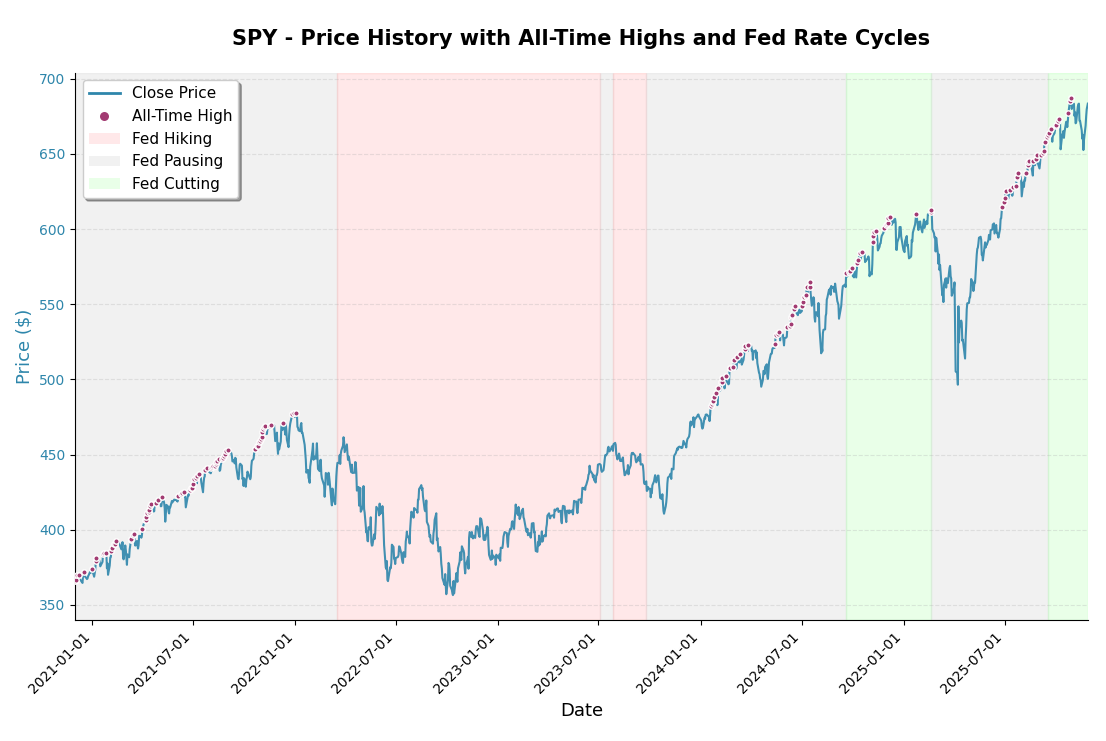

The past five years reveal how SPY performed across different Fed policy regimes.

🔴 Red zones (Fed hiking/raising rates)

2022 ~ early 2023: The 2022 hiking cycle saw SPY drop 23% (peak-to-trough) as the Fed fought 9.1% inflation with aggressive rate increases. Markets made virtually no all-time highs during this period, struggling under the weight of rapidly rising rates and recession fears.

⚪ Grey zones (Fed pausing/maintaining rates)

2021: Following the pandemic stimulus, SPY rallied strongly in 2021 while rates remained near zero.

Mid~late 2023: The 2023 pause allowed markets to digest the hiking cycle and eventually recover, though progress was choppy.

🟢 Green zones (Fed cutting/lowering rates):

2020: The emergency cuts during the COVID crash preceded a massive rally once stimulus kicked in, with SPY recovering from March lows to hit new all-time highs by August. (not in plot above)

2024~early 2025: The recent cutting cycle has coincided with SPY hitting frequent all-time highs, boosted by the post-election rally and soft landing optimism - though this was before tariff concerns emerged in April 2025.

Why “good cuts” drive rallies while hiking kills momentum

Higher rates increase the discount rate for future cash flows, making stocks mathematically less valuable.

The 2022-2023 hiking pain: Rates jumped from 0.25% to 5.5% in just 16 months. Every rally attempt was crushed by another hike, and SPY couldn’t sustain momentum until the Fed signaled they were done.

But when it comes to lowering rates, not all cuts are created equal: there’s a huge difference between “we’re cutting because inflation is under control” versus “we’re cutting because the economy is collapsing.”

“Good cuts” vs panic cuts: The 2024-2025 cuts came with inflation cooling toward target and the economy still growing - a soft landing scenario. Compare that to the 2020 emergency cuts during a pandemic crisis, which initially failed to stop the bleeding.

Direction matters more than levels: Markets rallied in 2023 even with rates at 5.5% once the Fed paused.

It’s not the absolute rate that matters — it’s whether rates are moving up (pain), sideways (uncertainty), or down (relief).

What December’s FOMC decision could mean for 2026

Markets have whipsawed on December cut expectations - from over 90% to 49% after Powell’s warnings, down to 29% following hawkish comments from Logan and others, then back to 90% as of writing after dovish remarks from Miran and Waller.

This potential pivot from cutting to pausing could change the market’s trajectory heading into 2026.