#251: Good buys into Wednesday's Fed meeting through March

In this email:

What’s at stake on Wednesday’s Fed meeting?

Themes leading up to the meeting

IMO: Good buys till March Fed meeting

What’s at stake on Wednesday’s Fed meeting?

This meeting isn’t about a rate cut. It’s about expectations control.

Key things the market is actually listening for:

Any shift in language around “confidence” in inflation progress

Whether Powell pushes back on early cut pricing

How united the committee sounds about timing

TOGETHER WITH: URnetwork (Sponsored)

All of the privacy and all of the fun.

Join a decentralized VPN that advances the state of the art of privacy, availability, security, and performance.

✨ Say goodbye to VPN - join URnetwork here!

Themes leading up to the meeting

1. Soft-landing confidence is high

Growth has held up. Labor data is cooling but not breaking. Inflation is drifting lower, so the whole “we have to watch out for medium to long term risk in inflation due to tariffs” argument is over (for now).

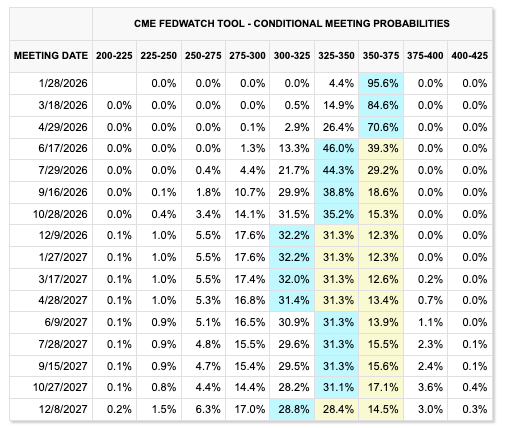

2. March is the real decision point

This meeting sets the path to March. Powell knows it. The market knows it. Everything said Wednesday is really about optionality two months from now, which means this meeting’s press conference matters less for rates, more for narrative discipline.

IMO: Good buys till March Fed meeting

This feels like a range-bound, selective risk-on window, not a chase-everything market.

With rates expectations flat and March as the true inflection point, I prefer assets that:

Don’t require cuts to work

Benefit from policy uncertainty rather than clarity

Hold value if narratives wobble

💡 A few that fit that box: