🦧 deepest spread so far

click logo above for 50% off!

normally speaking…

a yield curve is upward sloping, meaning: longer-term bonds have higher yields than short-term ones, because if you're lending your money to an entity for a longer time, that's added risk and you should get rewarded a higher yield

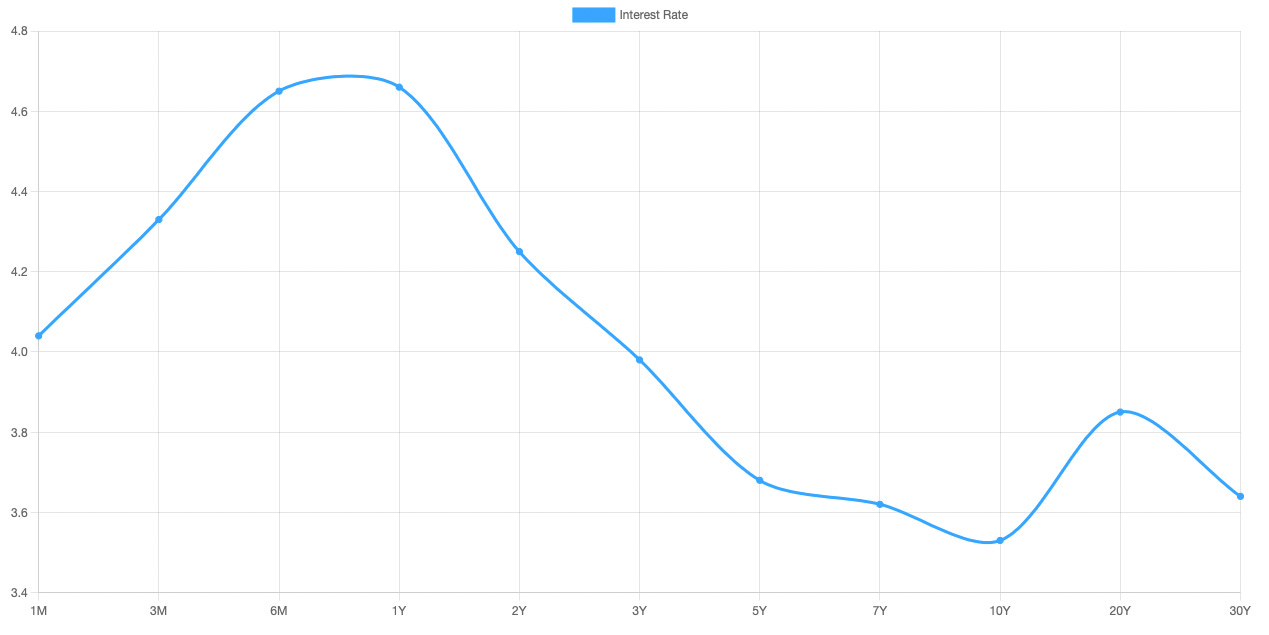

we've been at an inverted yield curve, specifically the us treasuries yield curve

as you see in the image above, as of writing, shorter term us treasury bonds (i.e. 2-year bond at 4.25% annualized) have way higher yield than longer term us treasury bonds (i.e. 10-year bond at 3.53% annualized)

what’s inverted mean anyways?

aside from the curve being downward sloping than upward sloping (as it normally should be), an inverted yield curve means that the market's pricing in a recession

in an economic downturn (like today's), investors tend to buy longer-dated bonds over short-dated bonds, which would bid up the price of longer bonds, driving down longer-term bond yields even more

how bad is it at the moment?

at the moment, 10-year us treasury yields are 0.78% below that of 2-year yields, the widest negative gap since 1981

this is also called the “10-2 year treasury yield spread"

the 10-2 year treasury yield spread should normally be positive (as 10 year treasury yields are typically higher than that of 2 year treasuries), but as you can see here, the spread's getting increasingly negative as the year progresses

happy december!

💡 something im thinking about

12k pound metal sculpture of elon musk's head (with a goat bod) was delivered to TSLA 0.00%↑'s headuarters (click image)